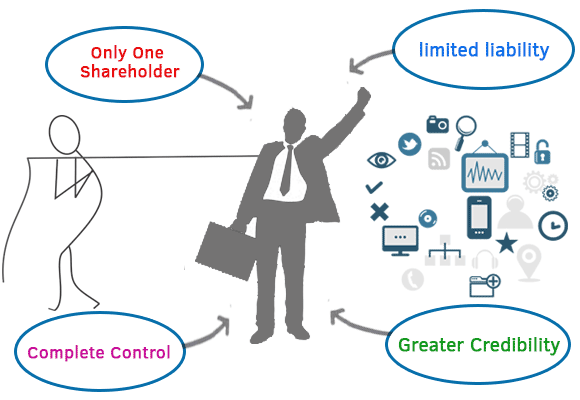

As the Name suggest One person company(OPC) means where only one member is Shareholder.The concept of One Person Company in India was introduced through the Companies Act, 2013 for the purpose of Incoportation an entity as like company.

This is good refinement of proprietorship firm.This is covered by the rule of Ministry Of Corporate Affairs {section 2(62)} of the companies Act 2013 ".Only natural person resident of India can be member in OPC.So it is a company which is owned by one single person.

SECTION APPLICABLE: Section 3 of Companies Act, 2013

RULES APPLICABLE: Rule 3 and 4 of Companies (Incorporation) Rules, 2014

Further, in case of OPC company has an average hattrick turnover of Rs. 2 crore and over or acquires a paid-up fund of Rs. 50 lacs and over, it has to be converted to a private limited company or public limited company within six months.Though a OPC have full control of one person but an OPC does have a few limitation for instance, every One Person Company (OPC) must nominate a nominee director in the MOA and AOA of the Company - who will become the owner of the OPC in case the sole Director is disabled.

MINIMUM REQUIREMENTS

*Minimum 1 Shareholder-Natural person,Cannot be minor,Indin citizen,resident in India

*Minimum 1 Director-and Maximum 15. director receive remuneration for their take care of management of company and member receive profit.The director and shareholder can be the same person

*Minimum 1 Nominee

*Letters ‘OPC’ to be suffixed with the name of OPCs to distinguish it from other companies.

PRELIMINARY CONDITIONS

(As per Rule 3 of Companies (Incorporation) Rules, 2014)

*Only a natural person who is an Indian citizen and resident in India can be member and nominee of an OPC.

*We can only incorporate only one OPC. The law does not permit the incorporation of more than one OPC by the same owner. This is the same case with regards to the nominee of an OPC also. A *nominee of an OPC cannot be a nominee of another OPC.

*No minor shall become member or nominee of the OPC or can hold share with beneficial interest in such OPC.

*Such Company cannot be incorporated or converted into a company under section 8 (Company with Charitable Objects) of the Act.

*Such Company cannot carry out Non-Banking Financial Investment activities including investment in securities of any other body corporate.

*No such company can convert voluntarily into any kind of company unless two years is expired from the date of incorporation of One Person Company except

*In the case if its falls under the mandatory conversion criteria.

*A natural person shall not be a member and nominee of more than a One Person Company at any point of time.

*Company shall state word ‘OPC’ in the bracket after the name of the Company, like XYZ (OPC) Private Limited.

OTHER IMPORTANT POINT ABOUT MANAGEMENT OF OPCs:

*In case the paid up share capital of an OPC exceeds fifty lacs rupees or its average annual turnover of immediately preceding three consecutive financial years exceeds two crore rupees, then the OPC has to mandatorily convert itself into private or public company.

*One Person Company shall file a copy of the financial statements duly adopted by its member, along with all the documents which are required to be attached to such financial statements, within one hundred eighty days from the closure of the financial year.

*The provision of holding of Annual General Meeting is not applicable to OPC

*The OPC is required to hold minimum two Board meeting during a calendar year and one meeting in each half of the calendar year and gap between two meetings is not more than 90 days.

*For the purposes of quorum, in case of a single Director, it shall be sufficient if the passed resolutions is entered in the minutes book and signed and dated by such director.

Documents Required

One Passport size photograph of Director & Nominee.

PAN card Soft copy of Director & Nominee.

Proof of Identity (Like-Voter ID, Passport, Driving License, Aadhar Card) of Director & Nominee.

Business address proof (Electricity Bill, Telephone Bill, Property, Gas Bill, Tax Bill) of Director.

Register office of all companies must be in India .If it is a Rented Property, Rent agreement and NOC from a landlord. If it is a Self-owned Property, Electricity bill or any other address proof.

Company Name (1 to 2 Names)

Company Service or product Name.

Valid Email id & Contact number of Director & Nominee.

Residence proof documents like bank statement or electricity bill should not be more than 2 months old.

All documents submitted must be valid and self attested.

FAQS

Can there be more than one Director in an OPC?

The minimum number of Directors required to form an OPC is one. However, there can be more than one up to 15 Directors. Please note that the restriction is on number of members and not Directors.

What if the existing single member dies?

The nominee appointed by the member shall become the member then.

WHO CANNOT FORM A ONE PERSON COMPANY?

A minor shall not eligible becoming a member Foreign citizen Non Resident Any person incapacitated by contract.

WHAT IS THE MANDATORY COMPLIANCE THAT AN OPC NEEDS TO OBSERVE?

The basic mandatory compliance are:- Atleast one Board Meeting in each half of calendar year and time gap between the two Board Meetings should not be less than 90 days. Maintenance of proper books of accounts. Statutory audit of Financial Statements. Filing of business income tax return every year before 30th September . Filing of Financial Statements in Form AOC-4 and ROC Annual return in Form MGT 7.

What if the nominee of the OPC die or the member wants to change the name of nominee at any given point of time?

The OPC and the member can at any time can change the name of the nominee of the OPC by following the procedure laid down in provisions of Rule 4 of the Companies (Incorporation) Rules, 2014. However, it is important to note that even the nominee can withdraw his consent at any time.

On interpretation of the law, it is stated that a single person can hold the position of member and nominee of a single OPC only. What if a situation arises when the nominee becomes member of the OPC when the member dies and along with it he is also the member of his own OPC?

In the given situation, the single person becomes member of two OPCs at the same time by virtue of circumstances and not voluntarily. In such a case, he shall meet the criteria as specified in the law within a period of 180 days.

Our Packages

.jpg)